I would like to start off by saying Happy New Year!

2019 is going to be a big year for all of us with Brexit looming and the start of those New Year resolutions…..yes, the New Year’s resolution you set; eat more healthy,

stop smoking, start saving for a deposit etc etc.

Whilst all these are great things, statistics show that 80% of New Year resolutions fail by February. So, what can you do that only takes a short amount of time, will potentially

last a life time, protect your assets and your family…. a Will ….. no matter what age you are you should seriously think about getting a Will Writing Company such as

Bristol and Bath FS to look at writing you a Will. If you are a unmarried couple and you own assets or have children then the stakes higher and not having a Will

could seriously impact your families future!

Why you should get a Will

You may be thinking I am only 25, I have years before I am even close to dying why would I consider getting a Will now….. If you have thought this then you are like the millions of other people in the UK who don’t have a Will. So, why should you get a Will now? It’s quite simple, if you die without a Will you die intestate. This basically means the courts will decide what happens to your estate, children and assets….. scary yeah!

There are 4 main reasons why you should have a Will:

- Your money will go to the rightful person(s)

- Your minor children will go to your chosen guardian

- Your assets such as your diamond ring will go to rightful person (not some deranged family member!)

- Save your family the additional stress

I will explore a scenario for a typical family who has no Will:

Family of 4; Tony (father), Sarah (mother), Lee (son age 6), Poppy (daughter age 8). They have no Will and have not considered the consequences

- Tony and Sarah are engaged but not married

- Mortgage of £150,000, owned as joint tenants; house worth approx. £250,000

- Life Insurance in place for £150,000 to cover the Mortgage, no trust in place

- Individual Life insurance in place to cover the family for £150,000 each, no trust in place

Now for the worst part:

Sarah unfortunately dies in a car crash, leaving Tony and their 2 children. Tony applies to the life insurance company and they agree to pay out a sum of £150,000 for the

mortgage and £150,000 from Sarah individual life policy.

This money goes into Sarah estate and because Tony and Sarah were not married, Tony is not entitled to anything.

Tony can continue to live in the house because the property was owned jointly (this will be very different if the property was owned as tenants in common) but he is not entitled

to anything else.

Tony has also just been told by his legal representative that because he was not married to Sarah that his children must go into care whilst Tony or the next of kin i.e. Sarah’s

mothers applies to become the administrator of the estate.

Once the administrator is appointed, the appointee can decide what will happen to the children. This could still mean

that Tony doesn’t get the children, in UK law the father of a child is not classed as a legal guardian unless the father of the child is married to the mother. Just imagine the

scenario where Sarah’s mother or sister is appointed and they decide that they are best for the children and their future!!

His children will then inherit the money plus anything else when they are 18.

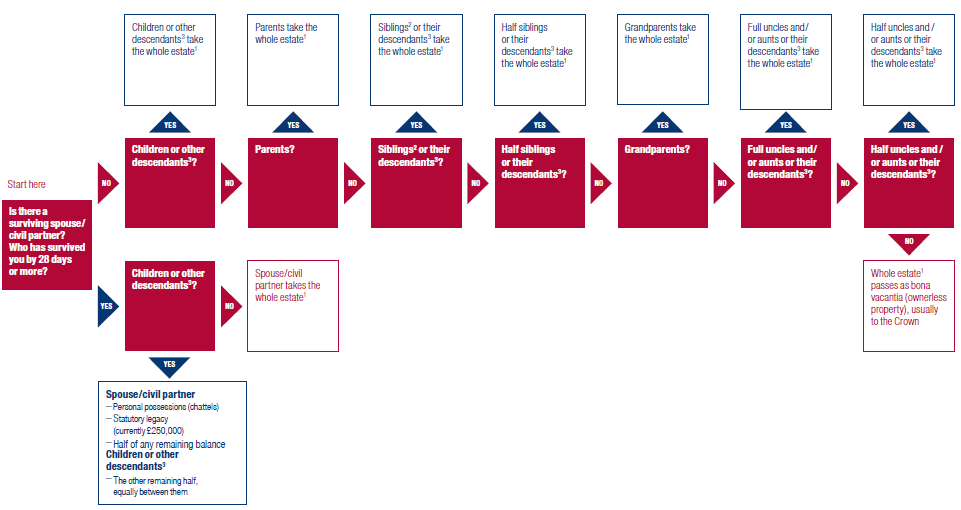

The following intestacy chart will show you what happens to money/assets if you are married/not married:

As you will see from the above, even if Tony and Sarah were married Tony will only be entitled to the first £250,000, anything above this will go to the children equally.

This could mean that other family members potentially would miss out on any special gifts or assets.

If Tony and Sarah were both to die without having a Will then again the children will go into care and they will inherit the whole estate once they turn 18. This could mean

that if the courts felt that the children were better looked after by another family they would then become the trustees of the estate and Tony and Sarah’s family will not

inherit a penny.

It doesn’t matter how long you have been with your partner, or how many children you have, the laws of intestacy are harsh and that’s why making a Will in 2019 should be your

priority.

Bristol and Bath Financial Services are a trusted Will Writing Company, whether you are looking for Will Writing in Bristol, Bath, Cardiff, Gloucester or further afield contact us now on 07786546380

Speak to Bristol and Bath Financial Services for the right advice. Contact us now through social media or email me here